I've been out of the loop for a while. I recall it being illegal to charge a finance fee, but they were a bit more negotiable for deals that were financed through us. We'd get cash reserves, a kick back from the bank. An opportunity to pack the deal, meaning they'd get the green light from the bank to borrow more than the price of the car, in hopes to sell an extended warranty and the Brooklyn Bridge along with the car. They'd also tell the customer they had to make at least four payments on the car, or they'd never be able to borrow money again. lol If they made less than three payments the bank would charge the dealership back the financial reserve money, which on a subprime loan for someone with bad credit was often 3% or more of the total loan. That was often a big chunk of the profit.Don't forget the financing fees they also add on.

Recently car shopping, had cash in my pocket, dealers hated that. Even If i was allowed to pay it off in a month, they still wanted a $500 financing fee. I bought My car from a private Seller, paid in cash.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

"Finance Only" Car Dealer

- Thread starter Warstud

- Start date

Boom and bust is how the big money is made. A crash is just an opportunity to buy low. Lending money to well-qualified people at 3%, even though they generally make every payment, is not a way to get rich. It's 3%. Any moron could do that by buying some blue chip stocks and sitting on them.

Mortgages were being written with basically no underwriting because there was always someone up the chain willing to buy the paper, no matter what it was. Key concepts being "securitization" and "default swaps." As a glut of buyers arrive with easily borrowed money, naturally it becomes a sellers' market and the prices shoot up. Same thing is happening with college tuition.

Last summer was a prime example, those who had some money, made a LOT MORE . When many stocks tumbled in April, May, June of 2020, people who had some cash, were buying up stocks, only to sell them shortly after, often just a couple of months later, making 150% to 450%. My Dad, relatives, Boss, and friends were doing it. I had very little money, but on my Father's stock account, he traded some stocks for me, with the $3,500 cash i gave him. Three months later that $4,500 became $11,200. Only wish that I had a million dollars to trade stocks then. My Dad was willing to gamble away $200,000 of his money, he walked away with $681,000 just 4 months later. Bought my new dualsport motorcycle with cash last summer, because the market crashed briefly. Look how well people are doing that purchased gold a few years ago while it was dipping down in price. For Christmas 2017, my Dad gave me an ounce of gold, I see it every morning, it's on the shelf in my closet as a reminder of how Great Dad is!

Just before I stop writing, a reasonable interest rate currently is no more than 4% for a car loan, anyone dumb enough to pay 8%, 12%, 20%, well it is hard to feel sorry for them. They can take 10 minutes to educate themselves before going to make a major purchase such as a car/motorcycle/boat.

Zee09

$200 Site Donor 2023

You should have jumped on that...lol..Not knowing...... I stopped at a "Finance Only" car dealer to look at a Blazer. I figured the Blazer was worth anywhere from $6000-$7500. The guy I spoke with said it was $13,000 at 22% interest. I was like "what" "what" then I asked how much it was with cash. He said they don't accept cash. I'm guessing this dealer targets people with bad credit and can't get a loan from the bank. Sound Right?

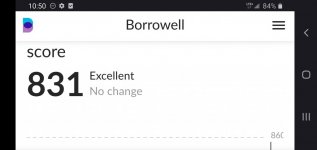

At only age 18, my credit score is already 831, and Visa keeps raising my credit limit, but I don't ask them to. They hate customers like me that pay it off monthly. My guess is they hope that now with a $50,000 credit limit, I may spend enough someday, that I cannot pay it off in full, and will need to pay it off over months, while they collect their outrageous 11.9% interest. Never going to happen!Originally Posted by SeaJay

Originally Posted by Wolf359

I don't think you really understand anything about mortgages and most of what you state can't be further from the truth. The lenders make money by originating the loan. That's why they have all those fees. They also make money when the sell the loan. That 3% loan isn't on their books, they've just made the loan and sold it. They have to conform to guidelines otherwise they can't sell the loans. Those are non-conforming and they're kept in house which is why they're known as portfolio loans and usually they only do 5 year ARMs on them because they don't want to get stuck with the same interest rate for 30 years. Prices have shot up because inventory is still low and demand still exceeds supply. Back in the boom years, there was way more inventory and a lot more construction going on. The underwriting is actually getting worse due to all the regulations that go passed. Lots of times there are delays, just talk to any mortgage broker/title company/real estate attorney.

Yes, U/W's made money on the origination. Yes, there are guidelines they need to conform to.

From what I've read (quite extensively) there were quite a few "fudges" of the truth somewhere between the initiation of the loan and when it was purchased (investment banks and the like). After purchase, it was divvied up and packaged as an investment vehicle. Many of the divvied up parts were A rated (moody's S&P) based on mathematical models of the risk of those parts. Sometimes it was necessary for the packager to "help" the raters to understand the math behind why the investment grade warranted an A rating. It is worth noting that the packagers paid quite a bit of fees to the raters to have their investment parts blessed by the rater with an A rating.

Then the divvied up parts were sold to the ultimate investor (the government of Iceland was one such investor) who for the most part understood they were purchasing a top investment blessed with an A rating, and thus carried virtually no risk of loss on the investment. Eventually these investors found out the harsh truth when their investments lost significant value when the boom crashed in late 2008

Yeah, that's what happened back before the crash. We used to do mortgages too and had those no money down, no income verification loans. Kinda funny when a homeless guy walked in once. I suppose from the advertising he could have also qualified, but I think he was just plain nuts. We humored him but he still needed a good credit score in order to qualify. We used to be able to get people who got paid under the table loans, but now that's all long gone, it's still much harder to qualify for a loan and I don't really run into very shaky buyers these days, they just wouldn't be able to compete with all the other buyers out there that have 20% or more. It might have eased up a little because loans used to get killed for very minor reasons, but that doesn't seem to happen as much anymore and the appraisers aren't as tough as they used to be. However many regulations were passed since those days and it's a mistake to say that easy money days are back again.

Attachments

At only age 18, my credit score is already 831, and Visa keeps raising my credit limit, but I don't ask them to. They hate customers like me that pay it off monthly. My guess is they hope that now with a $50,000 credit limit, I may spend enough someday, that I cannot pay it off in full, and will need to pay it off over months, while they collect their outrageous 11.9% interest. Never going to happen!

They don’t really hate you, they make money on all the processing fees from the retailer. But, you have the right idea in paying it off each month and keeping the cash back, points, miles, etc.

What kind of car did you buy?Don't forget the financing fees they also add on.

Recently car shopping, had cash in my pocket, dealers hated that. Even If i was allowed to pay it off in a month, they still wanted a $500 financing fee. I bought My car from a private Seller, paid in cash.

Zee09

$200 Site Donor 2023

Very smart gal...........At only age 18, my credit score is already 831, and Visa keeps raising my credit limit, but I don't ask them to. They hate customers like me that pay it off monthly. My guess is they hope that now with a $50,000 credit limit, I may spend enough someday, that I cannot pay it off in full, and will need to pay it off over months, while they collect their outrageous 11.9% interest. Never going to happen!

You have the right attitude. Check out the costco visa. It seems to pay back very well. Since you have the mindset of no debt and are disciplined, the credit card can pay you. I use it for everything just like cash, never carry a balance , we get back about $800-1000 every year.At only age 18, my credit score is already 831, and Visa keeps raising my credit limit, but I don't ask them to. They hate customers like me that pay it off monthly. My guess is they hope that now with a $50,000 credit limit, I may spend enough someday, that I cannot pay it off in full, and will need to pay it off over months, while they collect their outrageous 11.9% interest. Never going to happen!

I hope you didn't work for those shysters too long.I've been out of the loop for a while. I recall it being illegal to charge a finance fee, but they were a bit more negotiable for deals that were financed through us. We'd get cash reserves, a kick back from the bank. An opportunity to pack the deal, meaning they'd get the green light from the bank to borrow more than the price of the car, in hopes to sell an extended warranty and the Brooklyn Bridge along with the car. They'd also tell the customer they had to make at least four payments on the car, or they'd never be able to borrow money again. lol If they made less than three payments the bank would charge the dealership back the financial reserve money, which on a subprime loan for someone with bad credit was often 3% or more of the total loan. That was often a big chunk of the profit.

Long story short, I bounced around, they're were all crooks, and I went back to my business. But it was a great education, and I became very well versed at buying and selling cars. There were a few times I had dealings since then buying cars, truth is they were all inexperienced light weights. I even laughed at a few guys thinking they were going to pull something over on me. I'm actually grateful for the education I got, and I help friends and family when it comes time for them to buy a car.I hope you didn't work for those shysters too long.

GON

$100 Site Donor 2024

Memory is leaving me, but in the 1990s I did some studying on car loans. Typically two types. Simple interest and rule of 78.There is no law against buying the car, signing the finance papers and paying it off a week later. Just be certain there are no prepayment penalties, or any other catches with the loan. Me I'd pass on that dealer, prepayment penalties or not.

Simple interest is what you typically get when taking out a loan direct from a FDIC bank or credit union. You "simply" pay the interest that is due that month on the balance. If you pay the loan off early, you never overpaid on the interest.

A rule of 78 loan is what is often used when the finance department of a car dealership liaisons the finance. A rule of 78 loan has the finance charges paid off before the principal charges. So paying off a rule of 78 loan six months into a auto loan will have a substantially higher principal due than the same loan, at the same interest and payment, from the simple interest provided by a bank or credit union (direct- not going through the dealer).

So paying off a loan from a dealer early may not result in saving interests. I would never ever trust a dealer for financing.... ever....

Good point. Which is why I said: "Just be certain there are no prepayment penalties, or any other catches with the loan." If I plan on financing I have my credit score in advance and a loan already in place. One of the advantages in having good credit is you can get a good rate, and not get hosed by the dealer.Memory is leaving me, but in the 1990s I did some studying on car loans. Typically two types. Simple interest and rule of 78.

Simple interest is what you typically get when taking out a loan direct from a FDIC bank or credit union. You "simply" pay the interest that is due that month on the balance. If you pay the loan off early, you never overpaid on the interest.

A rule of 78 loan is what is often used when the finance department of a car dealership liaisons the finance. A rule of 78 loan has the finance charges paid off before the principal charges. So paying off a rule of 78 loan six months into a auto loan will have a substantially higher principal due than the same loan, at the same interest and payment, from the simple interest provided by a bank or credit union (direct- not going through the dealer).

So paying off a loan from a dealer early may not result in saving interests. I would never ever trust a dealer for financing.... ever....

GON

$100 Site Donor 2024

Rule of 78 (if I recall properly) has no prepayment penalty. It is simply WHEN the finance charge is paid. A rule of 78 (in theory), you pay off all the finance charge forecasted over the life of the loan, before any principal is paid. Although no pre-payment penalty, a dealer provided loan can have a significantly higher early payoff than an exact loan taken directly from a bank, under a simple interest.Good point. Which is why I said: "Just be certain there are no prepayment penalties, or any other catches with the loan." If I plan on financing I have my credit score in advance and a loan already in place. One of the advantages in having good credit is you can get a good rate, and not get hosed by the dealer.

My life experience is is is better to pay more, if need be, and go with a bank direct than have a dealer liaison financing for a new or used car purchase.

What kind of car did you buy?

A blue 2008 Honda Fit, with manual transmission.

It has lower than average kms for its age, garage kept, one owner, and in very nice condition. I was looking with my best friend, for her car last summer, saw many 2 to 5 year old cars that looked in much worse condition than my 13 year old car. The gentleman who previously owned it, was older, and took care of it.

You have the right attitude. Check out the costco visa. It seems to pay back very well. Since you have the mindset of no debt and are disciplined, the credit card can pay you. I use it for everything just like cash, never carry a balance , we get back about $800-1000 every year.

My Royal Bank Visa earns me a discount on gas at any Petro Canada Station, but earns me points with every purchase. In December I got my best friend an Amazon gift card, and myself a DJI Mavic Mini drone, just using points. Yesterday I got $42.36 of groceries for $0 using points. Points are GOOD!

Rule of 78 loans are extremely rare if anyone is making them at all now. Under rule of 78 the borrower will get a "refund of unearned interest" when paying off early, but it is based on an approximate formula. The mathematical difference between the rule of 78 and an exact calculation always favors the lender.

Also paying extra principle every month on a simple interest loan immediately reduces the interest cost for next month and thereafter, it does not work that way under rule of 78.

Also paying extra principle every month on a simple interest loan immediately reduces the interest cost for next month and thereafter, it does not work that way under rule of 78.

All valid points. Which is why you have to do your homework first. The dealers prey is someone with poor credit, and people with poor credit know they have poor credit, and are happy to get an approval. Even at loan shark rates. They also many times get suckered into an extended warranty. I remember F&I guys telling sub prime customers they had to take an extended warranty in order to get a loan. They'd tell them the bank is afraid if the warranty is up and they have a problem with the car they might not make loan payments. It worked quite well to sell a very costly extended warranty.Rule of 78 (if I recall properly) has no prepayment penalty. It is simply WHEN the finance charge is paid. A rule of 78 (in theory), you pay off all the finance charge forecasted over the life of the loan, before any principal is paid. Although no pre-payment penalty, a dealer provided loan can have a significantly higher early payoff than an exact loan taken directly from a bank, under a simple interest.

My life experience is is is better to pay more, if need be, and go with a bank direct than have a dealer liaison financing for a new or used car purchase.

Similar threads

- Replies

- 61

- Views

- 2K

- Replies

- 8

- Views

- 480