Saudi Arabia announced that it will cut back it's oil production by 5%, -500,000 barrels/day. Russia had announced the same earlier.

Iraq (211,00), UAE (-144,000), Kuwait (-128,000), Kazachstan (-78,000), Algeria (-48,000), Oan (-40,000) and Gabon (-8,000) will follow suit

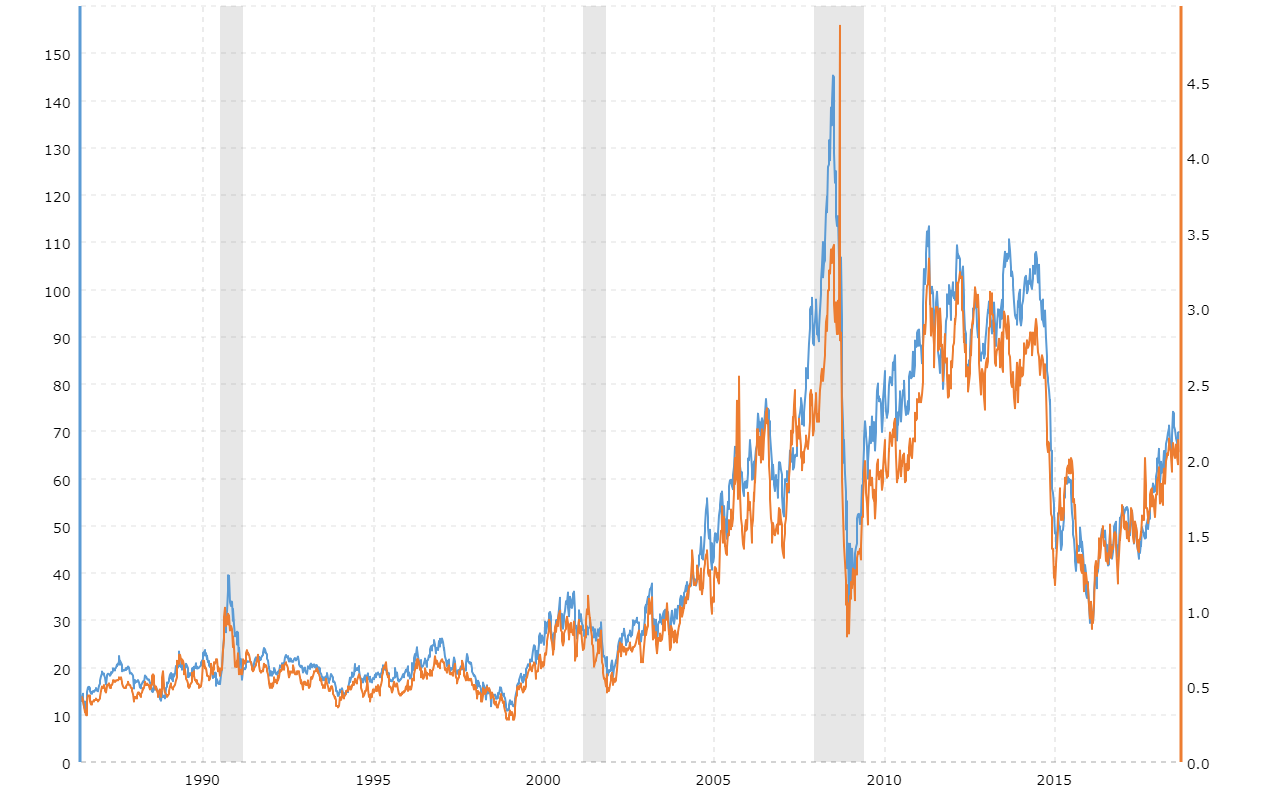

This will drop the worlds production by 1.5 % (including the Russian production cut) or over 1.6 million barrels per day in total. The price per barrel is expected to go up to the $95-$120 range by the end of the year, from around $80 now.

How are the strategic reserves doing at the moment?

Inflation is not going to end any time soon I expect

Iraq (211,00), UAE (-144,000), Kuwait (-128,000), Kazachstan (-78,000), Algeria (-48,000), Oan (-40,000) and Gabon (-8,000) will follow suit

This will drop the worlds production by 1.5 % (including the Russian production cut) or over 1.6 million barrels per day in total. The price per barrel is expected to go up to the $95-$120 range by the end of the year, from around $80 now.

How are the strategic reserves doing at the moment?

Inflation is not going to end any time soon I expect