If you lookup Florida real estate on YouTube, you'll find so many videos of insurance costs becoming too expensive with large deductibles (20k-25k). Many insurance companies pulling out of Florida. I wouldn't move there even if the house was free.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Florida Real Estate Advice

- Thread starter BISCUT

- Start date

Zee09

$200 Site Donor 2023

Central Florida like Ocala is still cheap. $400k houses a $1000 a year... but move a few miles in the wrong direction and you're screwed.If you lookup Florida real estate on YouTube, you'll find so many videos of insurance costs becoming too expensive with large deductibles (20k-25k). Many insurance companies pulling out of Florida. I wouldn't move there even if the house was free.

Some builders in the bad areas are providing insurance themselves. Like Maronda homes

$800k houses for $1489 a year homeowners...

Of course they just filed Chapter 11...

At that cost it might be worth to evaluate if to carry insurance at all and self insure instead. (assuming you dont have a mortgage)Whatever you do, do your research on Homeowner's insurance. It is insane down here. Worse on the West Coast by Tampa. There are people paying well over $10k a year for insurance.

I personally would not pay it.

- Joined

- Jun 8, 2022

- Messages

- 5,567

I am really not sure how you guys are getting such good rates anywhere in Florida.Central Florida like Ocala is still cheap. $400k houses a $1000 a year... but move a few miles in the wrong direction and you're screwed.

Some builders in the bad areas are providing insurance themselves. Like Maronda homes

$800k houses for $1489 a year homeowners...

Of course they just filed Chapter 11...

I am about 20 miles from the Carolina Coast. With the crazy pricing here house is likely worth maybe $600K at this point. Were in Flood zone X - which is "undefined - not really surveyed, 0.2% chance of flood per year - so 500 year flood zone I guess- not required but I get it - not sure why, we had the 1000 year flood supposedly and my lawn didn't even get wet. The floodplain behind me did though.

Homeowners is $2800 with a whole bunch of higher deductibles for wind.

Flood which is completely optional is another $700 from Fema.

Taxes are cheap, but only because I have lived here a long time and there limited to 3% increase a year.

Rising home values are zero benefit - but people don't understand. The only way rising values would be good is if your price increased and wherever you wanted to move to did not.

Zee09

$200 Site Donor 2023

Your actually doing good. My house in MD.I am really not sure how you guys are getting such good rates anywhere in Florida.

I am about 20 miles from the Carolina Coast. With the crazy pricing here house is likely worth maybe $600K at this point. Were in Flood zone X - which is "undefined - not really surveyed, 0.2% chance of flood per year - so 500 year flood zone I guess- not required but I get it - not sure why, we had the 1000 year flood supposedly and my lawn didn't even get wet. The floodplain behind me did though.

Homeowners is $2800 with a whole bunch of higher deductibles for wind.

Flood which is completely optional is another $700 from Fema.

Taxes are cheap, but only because I have lived here a long time and there limited to 3% increase a year.

Rising home values are zero benefit - but people don't understand. The only way rising values would be good is if your price increased and wherever you wanted to move to did not.

was about the same rate as yours and no flood zone. But you take your house and drop it on the cost and it could be $8k to $12k for homeowners...that's the killer... I don't even like $2800 but it beats the Florida coast rates

I'm sure it's not just Florida:

www.redfin.com

www.redfin.com

Florida’s Condo Prices Are Falling As Cost of Insurance and HOA Fees Skyrocket

Florida’s Condo Prices Are Falling As Cost of Insurance and HOA Fees Skyrocket

Florida’s condo market is faltering as the increasing intensity of natural disasters pushes up home insurance costs, and HOA fees soar in the wake of the 2021 Surfside condo collapse.

Brother and sister-in law have a really nice condo near Pensacola Beach, right on the water at English Navy Cove. They have experienced a meteoric rise in insurance and homeowner's maintenance cost, especially since Ian. They have a SFH in Gulf Breeze as well, but that hasn't been impacted much with rise in insurance premiums. They own nothing and are on the verge of self-insurance if the prices DO rise though and may end up selling the condo too. This is the area (Gulf Breeze/Navarre) where my wife and I want to settle into retirement and hope it doesn't get priced out of our range due to insurance. IF we can even get any. We plan to pay cash for the house anyway and may do the self-insurance route if we do move down there.

Other options are to just stay put in Upstate SC, but the traffic and taxes are getting worse by the day. Looking at Eastern TN near Knoxville too, not nearly as crowded as here. I don't mind winter when I don't have to go anywhere in it . Still have a couple years to decide.

. Still have a couple years to decide.

Other options are to just stay put in Upstate SC, but the traffic and taxes are getting worse by the day. Looking at Eastern TN near Knoxville too, not nearly as crowded as here. I don't mind winter when I don't have to go anywhere in it

I own rental property in Niceville, Florida near Eglin AFB. Close to 20 years ago my insurance company threw a tantrum over Florida insurance regs and wouldn't renew 3 of the 4 units. I cancelled the last one and have been self insured since then. Best move I ever made.

I'm sure it's not just Florida:

Florida’s Condo Prices Are Falling As Cost of Insurance and HOA Fees Skyrocket

Florida’s Condo Prices Are Falling As Cost of Insurance and HOA Fees Skyrocket

Florida’s condo market is faltering as the increasing intensity of natural disasters pushes up home insurance costs, and HOA fees soar in the wake of the 2021 Surfside condo collapse.www.redfin.com

There’s a real estate agent from Punta Gorda, FL on YouTube and he said the other day there’s a ton of condos that investors and property owners are desperately trying to dump.

I know a woman that her HOA is $788 per month for a condo in a 50 year old building in Hollywood, FL near Ft Lauderdale. I told her to sell ASAP and move into an apartment.

I asked her what she will do when HOA is $1000 per month… ?

Last edited:

Charles Bronson chose to live in Vermont, not New Hampshire.

As for Florida, I would avoid locations with alligators, Burmese pythons, hurricanes, flat land, and Disney.

About the only places in Florida I like are the Keys and St Augustine.

As for Florida, I would avoid locations with alligators, Burmese pythons, hurricanes, flat land, and Disney.

About the only places in Florida I like are the Keys and St Augustine.

GON

$100 Site Donor 2024

Dave, that is a good comment about an issue that is really big.There’s no limit what they will be charging in the future for insurance with all the hurricanes, storms, insurance fraud, lawsuits, etc….

I briefly have thought about ways to address the homeowner's insurance issues in Florida. What I scribbled in my brain is a minimum $25k deductible. I understand $25k is a hardship for many homeowners, but there are methods to make it work, like paying 2k USD per year towards a deductible reserve fund, etc. Just a hasty, informal thought- and I am sure numerous other issues that are caused by state laws that could be revoked, could be part of the solution for addressing homeowner insurance costs in Florida.

- Joined

- Jun 8, 2022

- Messages

- 5,567

Thought you said you disliked hurricanes?Charles Bronson chose to live in Vermont, not New Hampshire.

As for Florida, I would avoid locations with alligators, Burmese pythons, hurricanes, flat land, and Disney.

About the only places in Florida I like are the Keys and St Augustine.

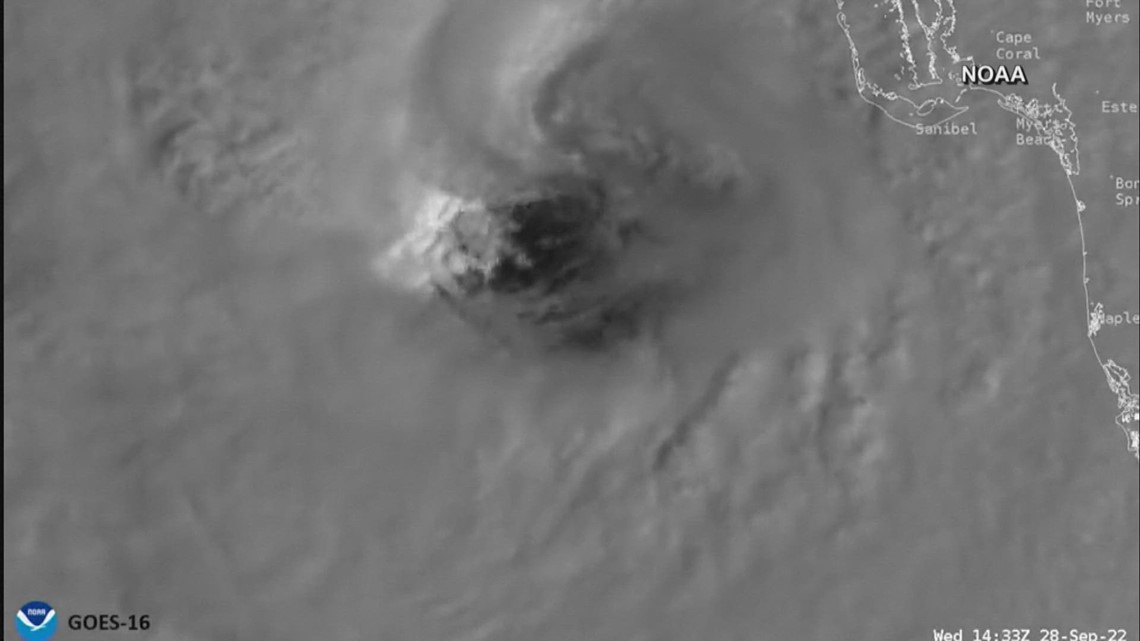

A look at some of the most powerful hurricanes to hit Florida

Hurricane Ian is expected to become one of the top five more powerful hurricanes to hit the state.

Zee09

$200 Site Donor 2023

I used to like St Augustine until I was reamed by the White Rogue Killer sitting on the monument across from the fort.. those were the days..Charles Bronson chose to live in Vermont, not New Hampshire.

As for Florida, I would avoid locations with alligators, Burmese pythons, hurricanes, flat land, and Disney.

About the only places in Florida I like are the Keys and St Augustine.

I go to Florida rarely, and when I do, never stay for more than two weeks. Outside the hurricane season.Thought you said you disliked hurricanes?

A look at some of the most powerful hurricanes to hit Florida

Hurricane Ian is expected to become one of the top five more powerful hurricanes to hit the state.www.firstcoastnews.com

I would never move there as a resident. I like a four season environment.

Florida four season environment consists of rain, heat, hurricanes ,big bugs

GON

$100 Site Donor 2024

Your thought of enjoying four seasons is becoming less popular every year. Many Americans in the north are wanting to avoid the cold and snow, especially as they get older. The statistics demonstrate a clear trend and speak for themselves.I go to Florida rarely, and when I do, never stay for more than two weeks. Outside the hurricane season.

I would never move there as a resident. I like a four season environment.

Florida four season environment consists of rain, heat, hurricanes humid.

GON

$100 Site Donor 2024

Your thought of enjoying four seasons is becoming less popular every year. Many Americans in the north are wanting to avoid the cold and snow, especially as they get older. The statistics demonstrate a clear trend and speak for themselves. My lovely Bride shares your thoughts on four seasons- but that is clearly not the trend, especially for aging adults.

I could not get windstorm coverage on my 2006 built home in Northwest Florida (Pensacola area), 20 miles from the coast sitting in the middle of a former farm field with no trees anywhere near. Some insurers would only insure homes LESS THAN ONE YEAR OLD! Others wouldn't insure unless I tore off a perfectly good roof and spent $30,000 on a new one. No thanks. I bought a policy with no windstorm coverage instead. Even that cost as much as I paid for full windstorm coverage a couple of years ago. If I moved 20 miles north across the Alabama line my insurance costs would be normal and property taxes would be less. I am seriously thinking about the move.

I will often take my out of state vacation in mid winter to a warmer climate. And allow winter sports friends to "house sit" at my place while I am gone. That mid winter break makes all the difference.Your thought of enjoying four seasons is becoming less popular every year. Many Americans in the north are wanting to avoid the cold and snow, especially as they get older. The statistics demonstrate a clear trend and speak for themselves.

Similar threads

- Replies

- 46

- Views

- 2K

- Replies

- 4

- Views

- 846

- Replies

- 45

- Views

- 3K

- Replies

- 30

- Views

- 1K