Originally Posted By: dparm

Originally Posted By: JHZR2

But I do think that no tax on "necessities" (most all unprepared foods, raw foods, most clothing, medicines, etc) is the best way to go. Tax on everything else, if its going to be taxed, OK, but stuff that people really do need is best left alone. That does, IMO benefit all.

Who gets to decide what is taxed and what is not? That opens up the floodgates to shady dealings, e.g. some senator owns a lot of stock of a corporation that would see a boost in sales if there was no tax on their products. Don't you think that would sway his decision to pass the tax exemption?

It's already kinda weird with the "luxury goods" taxes that are imposed -- very subjective. Or if you want to look at it from the public health angle, consider the NYC "large soda" taxes. Who defines what's "large"? And who's to say that I'm not healthy (however that's defined) just because I want a large Coke? People will just find a way around it -- by making the cup 1 oz smaller, or just buying two mediums. Or what about a Frappucino that's got more calories than the large Coke, yet evades the tax because it's a smaller container?

There's no perfect solution, sadly. Tax it, and you cause problems. Don't tax it, and you cause problems.

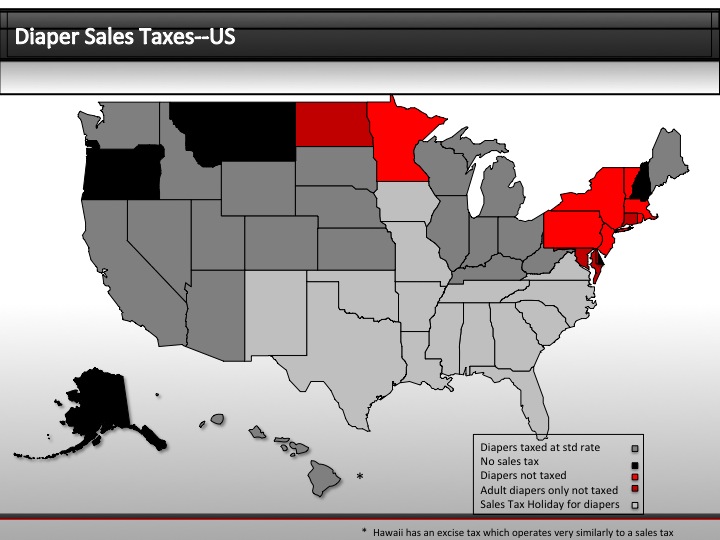

It's already implemented this way in many states.

Some states ai e lived in, VA and AL come to mind, tax everything. Some states tax nothing (DE). Others, like NJ, PA, NY, only tax necessities.

It's not brand name, it's not social engineering. It's what is considered a necessity, which is as I defined.

Want pre-prepared food? Not a necessity. Want carrots? Basic food is a necessity. Need pants? Necessity. Want a bathing suit? Not a necessity.

You can pick apart any system, but removing a tax burden on stuff that people at all levels need, isn't too bad, IMO.

Since this is a male-heavy site, I'll give this example: