How soon will we feel the effects ?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wordwide deflation? What's going on?

- Thread starter fdcg27

- Start date

- Status

- Not open for further replies.

Originally Posted By: LT4 Vette

How soon will we feel the effects ?

Who knows? I'm not sure either what the effects will be to be honest. We are in uncharted waters, but I'm sure there will be some unintended consequences. Prepers are crazy now but they might be right at the end.

How soon will we feel the effects ?

Who knows? I'm not sure either what the effects will be to be honest. We are in uncharted waters, but I'm sure there will be some unintended consequences. Prepers are crazy now but they might be right at the end.

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in PUBLIC debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

The problem is the exponential rise in PUBLIC debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Originally Posted By: friendly_jacek

Originally Posted By: GaleHawkins

I see deflation too if you are talking about income. The expenses are still inflating at my place.

Yup, this is what I'm talking about. The real wages are going down. I didn't have a raise since 2009. But I'm lucky not to lose my (relatively well paid) job. My wife did lose hers and only recently got a new job after years of looking.

Globalization basically means poor countries become richer and rich counties become poorer. The only thing is, the rich in US got richer. Go figure why.

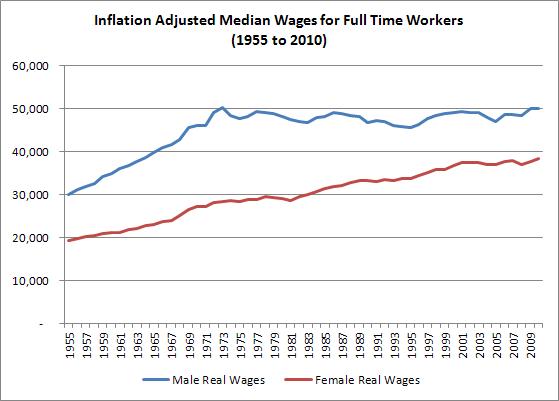

This is spot on. One of the biggest issues is wage growth has barley kept up with inflation for going on 40 years now. It peaked and has not risen. I think technology has a large part in it in addition to globalization.

Originally Posted By: GaleHawkins

I see deflation too if you are talking about income. The expenses are still inflating at my place.

Yup, this is what I'm talking about. The real wages are going down. I didn't have a raise since 2009. But I'm lucky not to lose my (relatively well paid) job. My wife did lose hers and only recently got a new job after years of looking.

Globalization basically means poor countries become richer and rich counties become poorer. The only thing is, the rich in US got richer. Go figure why.

This is spot on. One of the biggest issues is wage growth has barley kept up with inflation for going on 40 years now. It peaked and has not risen. I think technology has a large part in it in addition to globalization.

Originally Posted By: spasm3

The dollar has and is continuing to be devalued.

HUH? The dollar index has gone from 79 to 87 in the last year. The government is trying to stop that from happening! It hurts US companies globally.

Every country is trying to devalue their currency to get a global advantage. That's why China won't even let their currency float because if they did, it would explode higher from their trade surplus.

The dollar has and is continuing to be devalued.

HUH? The dollar index has gone from 79 to 87 in the last year. The government is trying to stop that from happening! It hurts US companies globally.

Every country is trying to devalue their currency to get a global advantage. That's why China won't even let their currency float because if they did, it would explode higher from their trade surplus.

Female wages seem low.

Is that wage chart correct ?

Is that wage chart correct ?

Originally Posted By: Drew99GT

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in PUBLIC debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Truth.

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in PUBLIC debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Truth.

Originally Posted By: friendly_jacek

Globalization basically means poor countries become richer and rich counties become poorer. The only thing is, the rich in US got richer. Go figure why.

It must be a complex system of regulations, law, money, power and influence (does that cover it all??

).

).

Quote:

The basic punchline is that wealth — accumulated asset ownership — is very, very concentrated and has been growing more concentrated for a generation. Back in 1980, 0.01 percent of the population owned three percent of national wealth. Today that top 0.01 percent, about 32,000 people, owns about 11 percent of national wealth. That's a staggering increase from an already high base.

http://www.vox.com/xpress/2014/10/14/6977789/saez-zucman-wealth

Globalization basically means poor countries become richer and rich counties become poorer. The only thing is, the rich in US got richer. Go figure why.

It must be a complex system of regulations, law, money, power and influence (does that cover it all??

Quote:

The basic punchline is that wealth — accumulated asset ownership — is very, very concentrated and has been growing more concentrated for a generation. Back in 1980, 0.01 percent of the population owned three percent of national wealth. Today that top 0.01 percent, about 32,000 people, owns about 11 percent of national wealth. That's a staggering increase from an already high base.

http://www.vox.com/xpress/2014/10/14/6977789/saez-zucman-wealth

Originally Posted By: Drew99GT

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in PUBLIC debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Umm, no.

You're right in stating that net assets may not change, but you're wrong in ascerting that QE does nothing to encourage economic growth.

The whole point of QE has been to release dollars locked up in federal debt for other investment or expenditure. Creating reserves to buy debt is printing money.

I'm not sure where you get the idea that the majority of people nowadays need to finance their daily living expenses.

We certainly don't and we don't know anyone who does, but we've always been prudent (maybe cheap) folks.

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in PUBLIC debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Umm, no.

You're right in stating that net assets may not change, but you're wrong in ascerting that QE does nothing to encourage economic growth.

The whole point of QE has been to release dollars locked up in federal debt for other investment or expenditure. Creating reserves to buy debt is printing money.

I'm not sure where you get the idea that the majority of people nowadays need to finance their daily living expenses.

We certainly don't and we don't know anyone who does, but we've always been prudent (maybe cheap) folks.

Originally Posted By: fdcg27

Originally Posted By: Drew99GT

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in private debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Umm, no.

You're right in stating that net assets may not change, but you're wrong in ascerting that QE does nothing to encourage economic growth.

The whole point of QE has been to release dollars locked up in federal debt for other investment or expenditure. Creating reserves to buy debt is printing money.

I'm not sure where you get the idea that the majority of people nowadays need to finance their daily living expenses.

We certainly don't and we don't know anyone who does, but we've always been prudent (maybe cheap) folks.

It is not money printing! How many times have I shown this on this board? By definition, money printing would mean a net increase in financial assets in the private sector of the economy. That is not what happens with QE. The Fed doesn't create reserves, it credits the accounts of primary dealers for treasuries.

http://pragcap.com/mechanics-qe-transaction

Now I will agree that markets think it's stimulus and therefor stocks go up and rates rise when they do implement QE. But the money never reaches main street, it does nothing to further lending since banks don't need deposits or reserves to fund loans as loans are what create deposits.

As far as people financing things with debt, it's good your and your family don't, but the median worker in the US does. Look at private debt; it's at record highs relative to GDP growth. That is the phenomenon of debt deflation.

http://www.theatlantic.com/business/arch...debt-is/379865/

Originally Posted By: Drew99GT

The problem is that QE does nothing. zilch, zip, notta, to increase economic growth. The Fed simply bought treasuries on the open market which IS NOT MONEY PRINTING at all. It is an asset swap. They bought your treasury bond, now you have cash. Same amount of net assets in the economy. It can't be money printing by accounting identity. The only time the government "prints money" in any kind of form is when they run a budget deficit at the federal level and in some circumstances, when they buy mortgage backed securities.

The problem is the exponential rise in private debt. It is called debt deflation. The majority of people now adays have to finance their day to day living beyond anything imaginable 50 years ago. That reaches a point where it stunts economic growth and leads to slowing CPI. I'm even seeing slowing price rises at the grocery store. Gas is under 3 bucks a gallon now.

Umm, no.

You're right in stating that net assets may not change, but you're wrong in ascerting that QE does nothing to encourage economic growth.

The whole point of QE has been to release dollars locked up in federal debt for other investment or expenditure. Creating reserves to buy debt is printing money.

I'm not sure where you get the idea that the majority of people nowadays need to finance their daily living expenses.

We certainly don't and we don't know anyone who does, but we've always been prudent (maybe cheap) folks.

It is not money printing! How many times have I shown this on this board? By definition, money printing would mean a net increase in financial assets in the private sector of the economy. That is not what happens with QE. The Fed doesn't create reserves, it credits the accounts of primary dealers for treasuries.

http://pragcap.com/mechanics-qe-transaction

Now I will agree that markets think it's stimulus and therefor stocks go up and rates rise when they do implement QE. But the money never reaches main street, it does nothing to further lending since banks don't need deposits or reserves to fund loans as loans are what create deposits.

As far as people financing things with debt, it's good your and your family don't, but the median worker in the US does. Look at private debt; it's at record highs relative to GDP growth. That is the phenomenon of debt deflation.

http://www.theatlantic.com/business/arch...debt-is/379865/

Last edited:

Originally Posted By: fdcg27

The whole point of QE has been to release dollars locked up in federal debt for other investment or expenditure.

Think about this statement. How can the federal government free up dollars locked up in federal debt when that debt, because it is denominated in US dollars, came into existence via deficit spending??? The fed CAN'T "free up dollars" that were already created out of thin air. Short of buying mortgage backed securities, equities, or corporate bonds (ie, anything in the private sector), anything any national reserve bank in a country that is monetarily sovereign does simply rearranges the countries balance sheet. It can't create more net new financial assets by buying treasury bonds because those bonds came into existence through deficit spending. Federal debt in a monetarily sovereign economy isn't really debt like Argentina, or Greece, or Italy's debt is because those debts aren't denominated in those countries currencies. This is why bank lending didn't increase substantially from QE or any other federal reserve programs. Banks don't need the money to be able to lend, they need credit worthy borrowers and a demand for loans. As shown above, people are leveraged up to their eyeballs already.

The whole point of QE has been to release dollars locked up in federal debt for other investment or expenditure.

Think about this statement. How can the federal government free up dollars locked up in federal debt when that debt, because it is denominated in US dollars, came into existence via deficit spending??? The fed CAN'T "free up dollars" that were already created out of thin air. Short of buying mortgage backed securities, equities, or corporate bonds (ie, anything in the private sector), anything any national reserve bank in a country that is monetarily sovereign does simply rearranges the countries balance sheet. It can't create more net new financial assets by buying treasury bonds because those bonds came into existence through deficit spending. Federal debt in a monetarily sovereign economy isn't really debt like Argentina, or Greece, or Italy's debt is because those debts aren't denominated in those countries currencies. This is why bank lending didn't increase substantially from QE or any other federal reserve programs. Banks don't need the money to be able to lend, they need credit worthy borrowers and a demand for loans. As shown above, people are leveraged up to their eyeballs already.

Of course buying up government debt increses the dollar float.

Where else would the dollars to fund this debt have come from?

It doesn't matter whether the Fed buys Treausuries, corporate bonds, securitized credit card debt or your Aunt Tilly's mortgage.

The dollars in circulation increase in any event.

Bank lending to prime borrowers has increased, and I could go to the bank today and borrow any amount I wished to fund whatever collateralized purchase I might wish to make at interst rates that would make you cry.

Marginal borrowers can't, since lenders have figured out that a debtor who can't pay back his debts is a bad bet in a market where the value of the collateral might evaporate like a chunk of dry ice left in the sun.

The housing finance crisis was caused by the loss in value of the collateral.

Had collateral values held, there would have been no problem.

Where else would the dollars to fund this debt have come from?

It doesn't matter whether the Fed buys Treausuries, corporate bonds, securitized credit card debt or your Aunt Tilly's mortgage.

The dollars in circulation increase in any event.

Bank lending to prime borrowers has increased, and I could go to the bank today and borrow any amount I wished to fund whatever collateralized purchase I might wish to make at interst rates that would make you cry.

Marginal borrowers can't, since lenders have figured out that a debtor who can't pay back his debts is a bad bet in a market where the value of the collateral might evaporate like a chunk of dry ice left in the sun.

The housing finance crisis was caused by the loss in value of the collateral.

Had collateral values held, there would have been no problem.

Originally Posted By: LT4 Vette

Female wages seem low.

Is that wage chart correct ?

Sometimes when those charts are made, they just take every man's and every woman's income and averages it. Other times, stay-at-home parents end up on such charts, even though they aren't in the labor force.

It doesn't show what job each man and each woman has, and it doesn't show how many hours were worked during the year.

Female wages seem low.

Is that wage chart correct ?

Sometimes when those charts are made, they just take every man's and every woman's income and averages it. Other times, stay-at-home parents end up on such charts, even though they aren't in the labor force.

It doesn't show what job each man and each woman has, and it doesn't show how many hours were worked during the year.

Originally Posted By: LT4 Vette

How soon will we feel the effects ?

That's what I'm wondering. I wish mozzarella cheese would go down in price. Right now I'm paying $4.18 per pound at Walmart. That's for the Galbani Precious brand.

How soon will we feel the effects ?

That's what I'm wondering. I wish mozzarella cheese would go down in price. Right now I'm paying $4.18 per pound at Walmart. That's for the Galbani Precious brand.

Originally Posted By: GaleHawkins

I see deflation too if you are talking about income. The expenses are still inflating at my place.

I agree.

I see deflation too if you are talking about income. The expenses are still inflating at my place.

I agree.

The market pays high wages for value and high demand skills in the labor market. I have seen my salary go up by a factor of apprx 15x from my first professional job in 1978. That is because I worked my butt off on a regular basis through the years to keep my skills current and move to positions of increasing responsibility in my high tech industry. If a person's wages are stagnant for many years they need to take action and put in the investment and hard work to do something about it. If a person wants to make a high wage and they are willing to invest in good training/education and then work hard to keep skills current their wages will stay high. Too many slugs in the US working jobs for years that take little or no training or specialized skills to perform yet they seem to expect to earn premium wages and to have those wages increase very year...why? Your wages will go up when you work and invest in your skills to become more valuable in the marketplace. In other words you EARN the higher wages. Your wages will not magically go up when prices and inflation goes up.

Last edited:

Originally Posted By: cashmoney

Your wages will not magically go up when prices and inflation goes up.

At least some of us have figured this out!

Your wages will not magically go up when prices and inflation goes up.

At least some of us have figured this out!

Originally Posted By: SteveSRT8

Originally Posted By: cashmoney

Your wages will not magically go up when prices and inflation goes up.

At least some of us have figured this out!

Deflation is due to stagnant wages and DROPPING wages.

Yes, if you include inflation calculations into wages

many folks have wages that are actually going DOWN.

As prices rise, people stop buying what they cannot afford and prices will drop.

Originally Posted By: cashmoney

Your wages will not magically go up when prices and inflation goes up.

At least some of us have figured this out!

Deflation is due to stagnant wages and DROPPING wages.

Yes, if you include inflation calculations into wages

many folks have wages that are actually going DOWN.

As prices rise, people stop buying what they cannot afford and prices will drop.

- Status

- Not open for further replies.

Similar threads

- Replies

- 13

- Views

- 859

- Replies

- 43

- Views

- 3K

- Replies

- 50

- Views

- 5K

- Replies

- 68

- Views

- 6K