Originally Posted By: Tempest

Quote:

Do you not realize that there are economists in universities, government and elsewhere who model these things?

I realize that these things are "modeled" all the time. I have yet to see any conclusive proof.

Quote:

Of course there is a multiplier effect. Its a given! There's no dispute about this.

Then it should be very easy to provide the proof that I am requesting.

Quote:

Now you're debunking the CBO? Hilarious!

Is it "out of context" to ask for the reliability of sources?

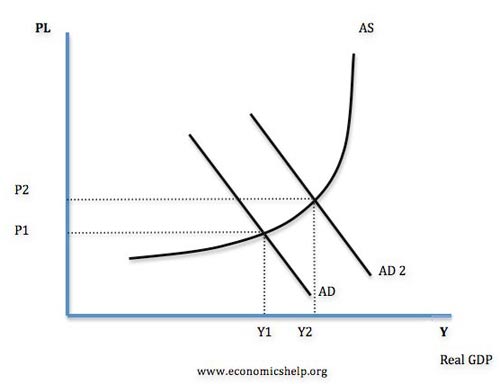

Please provide me with exact numerations for the x and y axis.

These must be known in order to correctly "model" the amount of wealth that must be transferred from one group to another so the "multiplier effect" can kick in so as to increase "aggregate" demand.

Without specific numbers, any amount of wealth transferred is strictly arbitrary and without rational.

So let me get this right, you don't believe there is a multiplier effect at all and you need proof this it exists?

So when you next go and spend a dollar, you don't believe that part of that dollar is then spent by that business on whatever (wages, cost of goods sold, overheads) and then the people who receive that money don't spend it and so on.

So the net effect of spending a dollar is more than a dollar of economic activity. But you don't believe that?

Then you also don't believe that different types of spending and different groups of people have a different marginal propensity to consume and make different choices?

And you don't understand that in the short term there are different effects that a $ could have depending on how it's used?

So you couldn't do some googling and find that Mark Zandi in 2008 said that any form of increased govt spending would have a greater multiplier effect than any form of tax cuts? And that an increase in food stamps had the highest multiplier effect of 1.73 while accelerated depreciation was .27? The Bush tax cuts would be .29?

You also realize that in a recession and even now, private capital is not being lent out so anyone with the ability to save reduces the multiplier effect whether it is a transfer or not. People with money spend less in a recession, people with no money spend the same because they spend on necessities.